As a contractor, you’re a master of your trade, transforming spaces with skill and precision. But when it comes to bookkeeping, you might find yourself on shaky ground.

I commonly see contractors struggle with setting up their Chart of Accounts, their product and service list, a receipt management system, and a business bank account. Sometimes they just need accountability to see that these things get done and done correctly.

But don’t worry – with the right system, you can build a solid financial foundation for your business, just as you do for your clients’ projects.

In this article, I’m going to share the six steps you need to set up a bookkeeping system for your contractor business. And if that still seems overwhelming, I’ll explain how a virtual bookkeeper may be exactly what you need to move forward with confidence.

Understanding Bookkeeping Basics

A bookkeeping system is the backbone of your business finances, tracking all monetary transactions and providing a clear picture of your financial health.

It consists of four key components:

- Accounts Payable, which tracks money owed to suppliers and creditors

- Accounts Receivable, monitoring money owed by clients

- Payroll, managing employee compensation

- Financial Reporting, offering comprehensive insights into your business’s performance

These components work in concert to provide valuable insights, driving strategic decision-making and business growth.

Setting Up a Bookkeeping System for Your Contractor Business

STEP 1: Choosing Your Software

The first step in establishing your bookkeeping system is choosing the right software.

I like to recommend QuickBooks Online for contractors because of its user-friendly interface, cloud-based accessibility, and comprehensive features tailored for project-based businesses. It offers scalability for growing businesses and integrates well with other business tools.

While QuickBooks Online is my preferred choice, it’s important to evaluate your specific needs and consider other options that might be suitable for your business. The key is to select software that offers robust job costing, project tracking, and expense management features.

STEP 2: Set Up Your Chart of Accounts

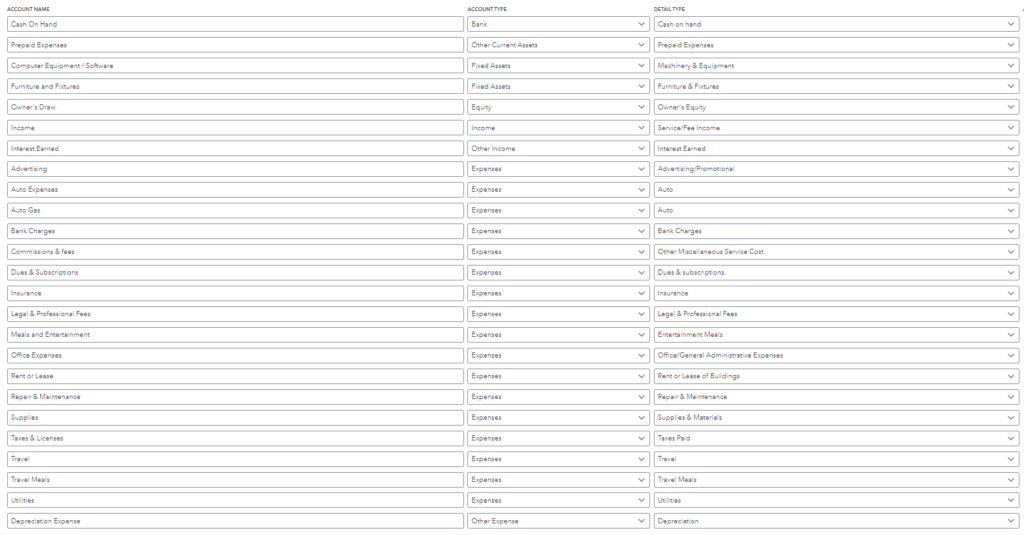

A chart of accounts is essentially the organizational framework for your business’s financial data. It’s a list of all the accounts used to categorize your financial transactions. For contractors, it’s crucial to tailor this chart to reflect the specific nature of your business.

When setting up your chart of accounts, consider including categories such as:

- Income accounts (e.g., Residential Projects, Commercial Projects)

- Expense accounts (e.g., Materials, Subcontractor Payments, Equipment Rental)

- Asset accounts (e.g., Tools and Equipment, Vehicles)

- Liability accounts (e.g., Loans, Credit Cards)

Remember, the goal is to create a structure that allows you to easily track and categorize your financial activities in a way that makes sense for your contracting business.

STEP 3: Establish a System for Tracking Income and Expenses

Accurate tracking of income and expenses is fundamental to maintaining healthy business finances. For contractors, this process can be more complex due to the project-based nature of the work.

For income tracking:

- Create a system for promptly recording all payments received from clients.

- Categorize income by project type (e.g., residential, commercial, renovations).

- Ensure you’re capturing all forms of income, including progress payments and final invoices.

For expense tracking:

- Implement a method for recording all business-related expenses, no matter how small.

- Categorize expenses to align with your chart of accounts.

- Consider using a dedicated business credit card to simplify expense tracking.

It’s crucial to maintain a clear separation between personal and business finances. This separation not only simplifies your bookkeeping but also provides a clearer picture of your business’s financial health and helps immensely during tax season.

STEP 4: Implement Job Costing

Job costing is particularly important for contractors as it allows you to track the profitability of individual projects. This process involves allocating all costs — direct materials, labor, and overhead — to specific jobs.

To implement effective job costing:

- Set up each new project as a separate job in your accounting software.

- Assign all related income and expenses to the specific job

- Regularly review job costs against your initial estimates to track profitability.

This level of detail allows you to identify which types of projects are most profitable, helps in more accurate future estimates, and can highlight areas where costs might be reduced.

STEP 5: Manage Invoicing and Payments

Effective invoicing and payment management are critical for maintaining healthy cash flow.

Create clear, detailed invoices, establish a consistent invoicing schedule, and communicate payment terms clearly to clients. Consider offering multiple payment options to make it easier for clients to pay promptly, and follow up quickly on overdue payments.

STEP 6: Stay on Top of Payroll and 1099 Filings

If you have employees, managing payroll accurately and on time is crucial. This includes:

- Calculating wages, overtime, and deductions correctly.

- Ensuring timely payment to employees.

- Staying compliant with tax withholding and reporting requirements.

For subcontractors, proper management of 1099 filings is essential:

- Keep detailed records of payments made to each subcontractor.

- Ensure you have W-9 forms on file for all subcontractors.

- Prepare and file 1099 forms accurately and on time.

Consider using payroll software that integrates with your bookkeeping system to streamline these processes and reduce the risk of errors.

By implementing these steps, you’ll create a comprehensive bookkeeping system tailored to your contracting business. This system will provide you with the financial clarity and insights needed to make informed business decisions and drive your company’s growth.

The Role of a Virtual Bookkeeper

While setting up a bookkeeping system may seem daunting, partnering with a virtual bookkeeper can make the process seamless and efficient. Here’s how a virtual bookkeeper can guide you through each step:

- Choosing Your Software: A virtual bookkeeper can assess your specific needs and recommend the most suitable software. They’re often experts in QuickBooks Online and can set it up efficiently, tailoring it to your contracting business.

- Setting Up Your Chart of Accounts: With their industry-specific knowledge, a virtual bookkeeper can create a chart of accounts that perfectly aligns with your contracting business. They understand the nuances of construction accounting and can ensure your financial framework is optimized from the start.

- Establishing Income and Expense Tracking: Your virtual bookkeeper can implement robust systems for tracking income and expenses, ensuring all transactions are properly categorized. They can set up bank feeds, create rules for automatic categorization, and establish protocols for handling different types of income and expenses specific to contracting work.

- Implementing Job Costing: This crucial aspect of contractor bookkeeping is where a virtual bookkeeper truly shines. They can set up detailed job costing systems within your software, train you on how to assign costs to specific projects, and create reports that give you clear insights into the profitability of each job.

- Managing Invoicing and Payments: A virtual bookkeeper can streamline your invoicing process, setting up templates, establishing schedules, and even handling the sending of invoices and follow-ups on overdue payments. This ensures you maintain a healthy cash flow while you focus on your projects.

- Handling Payroll and 1099 Filings: A virtual bookkeeper can manage your payroll system, ensuring accurate calculations and timely payments. They can also handle the complexities of 1099 filings for your subcontractors, keeping you compliant with tax laws.

By entrusting these tasks to a virtual bookkeeper, you ensure they’re done correctly. You’ll also free up your time to focus on growing your business.

Virtual bookkeepers offer flexibility, scaling their services as your business grows, and provide ongoing support to keep your finances on track. They conduct regular reviews, generate insightful reports, and offer valuable advice based on your financial data.

“Mrs. Mawson is very efficient and we have appreciated the time she takes to explain our records in detail during every meeting. She is doing an excellent job for my business as our bookkeeper.” ~ Johnny P., Owner, J&J Construction

Plus, a virtual bookkeeper is cost-effective. You get expert financial management without the overhead of a full-time employee.

Their familiarity with construction industry standards and best practices means they can often spot opportunities for improvement or potential issues before they become problems.

In essence, a virtual bookkeeper doesn’t just set up your system – they become a valuable partner in your business’s financial health, providing you with the clarity and confidence you need to make informed decisions and drive your contracting business forward.

Your Next Move Toward Financial Clarity

Ready to take control of your contractor business finances?

Don’t let another day go by with uncertainty about your bookkeeping. Schedule a free Discovery Call with Deborah Mawson Bookkeeping today. In just 30 minutes, we’ll assess your current bookkeeping practices and provide tailored recommendations to streamline your financial management.

Let’s work together to set up a robust bookkeeping system that will give you the clarity and confidence you need to grow your business. Click here to book your Discovery Call now. Your future self (and your bottom line) will thank you!